Attualità

Rationality and the Euro (Razionalità ed Euro) – Paul Krugman

Segnaliamo un articolo di oggi dell’economista e premio Nobel, Paul Krugman. IL POST E’ IN LINGUA INGLESE

Simon Wren-Lewis, for once, has a happy story to tell. He looks back at Britain’s fateful decision, ten years ago, not to join the euro, and argues that the decision was made on the basis of — gasp! — actual analysis. Gordon Brown (who deserves a much better rap than he gets) brought in real economic experts, who used a real economic framework — optimum currency area theory — and concluded that the case for euro membership was not good.

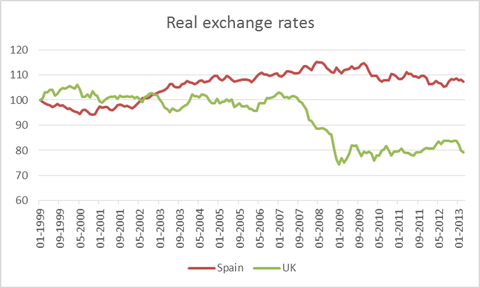

And boy, was that a good call; despite the best efforts of Osborne and Co. to mess it up, there’s no comparison between British woes and those of other European nations that had large capital inflows and housing booms. Partly this is because of the De Grauwe point, which was imperfectly grasped in 2003 — the crucial importance of having your own central bank as lender of last resort for sovereign borrowing. But it’s also largely because of a point that was perfectly well understood in 2003 and has been confirmed by experience: “internal devaluation”, reducing relative prices with a fixed exchange rate, is really hard compared with just devaluing your currency. Here are BIS estimates of the Spanish and UK real exchange rates, 1999-01 = 100:

Notice how Britain effortlessly achieved a real depreciation that, if it’s possible at all, will take years and years of mass unemployment in Spain.

Unfortunately, Wren-Lewis’s description of an actual rational decision process is all too rare — perhaps especially when it comes to the euro. Talk to euro advocates and they cannot entertain, even as a hypothetical proposition, the notion that the single currency was a bad idea; I came away from one talk with the clear message that the euro cannot fail, it can only be failed, that any problems simply show that countries and leaders lack sufficient nobility of purpose.

And despite the overwhelming evidence that the euro was an even worse idea than it appeared 10 years ago, countries — notably Poland — are still considering joining. I understand that leaving the euro is a very difficult thing to contemplate; but getting in now, when you had the great good luck to avoid this mess? Awesome.

articolo postato da Andrea Lenci (@andrealenci)

segnalate eventuali articoli interessanti, di carattere economico, a: andrea.lenci@email.it

Account Social Network Scenarieconomici.it – Facebook – Twitter

Pingback: “Impatto economico dell’uscita dall’euro dei paesi sud europei” secondo la Bertelsmann Stiftung: l’Italia possibile artefice del crollo economico mondiale? | Scenarieconomici.it