Esteri

The Obama legacy will imply recession and market crashes? A try to put the blame on Trump, but the culprit is the former President!

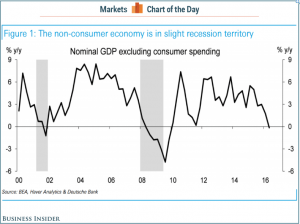

It is weeks that I am collecting data demonstrating why the US economy is close to recession. In fact probably USA is already in recession; then a stock market crash will follow, as expected.

First of all, the dollar is too high and it is annihilating US corporate profits, coincidentally the greenback began unexpectedly to rise to unsustainable levels just after the Trump electoral victory that theoretically – according to Wall Street analysts, pre election – should have led to a collapse in the stock market. Collapse that did not occur, quite the opposite.

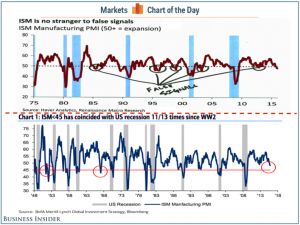

I propose a slew of graphs that can explain in details why we are so close to a pronounced US economic decline; it seems odd that the US financial sector – largely in Democratic hands – for the moment continues to praise Obama as a great US President even after the US Dem party stinging defeat:

This index (Index of Coincident Economic Indicators) never failed at predicting recession since 1965; in november it turned into “recession mood”

This index (Index of Coincident Economic Indicators) never failed at predicting recession since 1965; in november it turned into “recession mood”

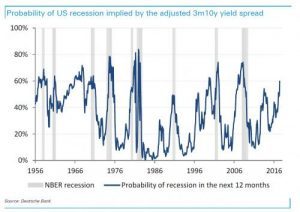

Probability of recession, DB, beginning/mid 2016

Probability of recession, DB, beginning/mid 2016

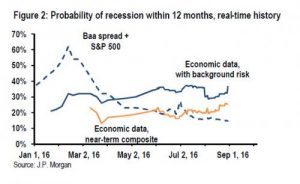

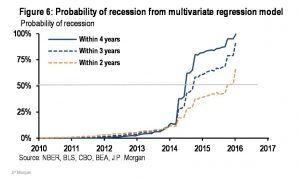

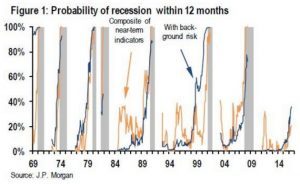

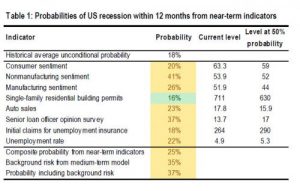

Probability of recession, JPM, 4 slides, June 2016

Probability of recession, JPM, 4 slides, June 2016

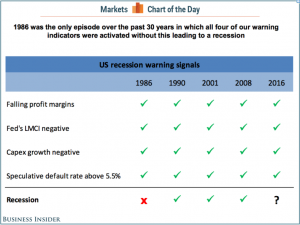

Various indicators & sources (see the slides for details) showing high probability of recession during 2017

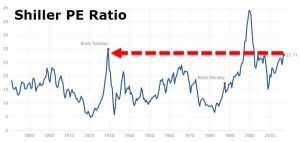

Various indicators & sources (see the slides for details) showing high probability of recession during 2017  Shiller P/E indicator, at great depression level (and also very close to the 2008 level)

Shiller P/E indicator, at great depression level (and also very close to the 2008 level)

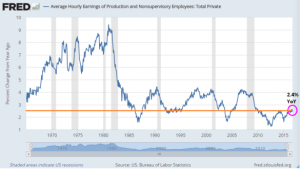

Crash in productivity growth under Obama; USA is lucky Mario Monti is “not applicable” to sort out the US issue…

Crash in productivity growth under Obama; USA is lucky Mario Monti is “not applicable” to sort out the US issue…

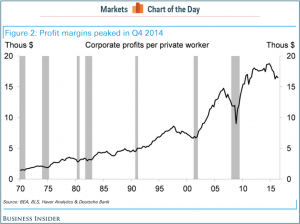

Now some indicators showing the fundamental weakness of the US economy during the supposed “Obama economic recovery”, especially with regard to the last presidential mandate 2012-2016:

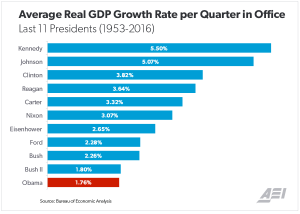

GDP growth under Obama presidency is the worst since the end of WWII

GDP growth under Obama presidency is the worst since the end of WWII

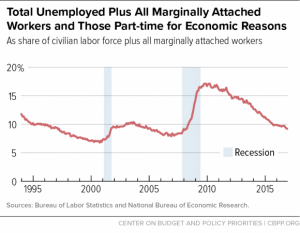

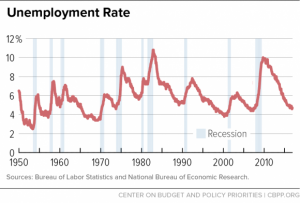

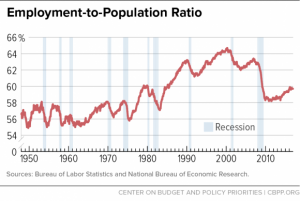

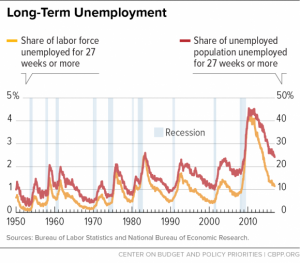

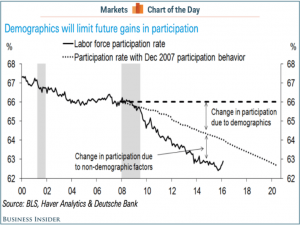

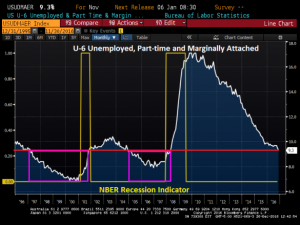

Various labour employment/unemployment indicators, showing a “not so briliant situation” (even particularly alarming, at least with regard to labour participation and employment to population rates plus the recession skewed Fed Labour indicator)

Various labour employment/unemployment indicators, showing a “not so briliant situation” (even particularly alarming, at least with regard to labour participation and employment to population rates plus the recession skewed Fed Labour indicator)

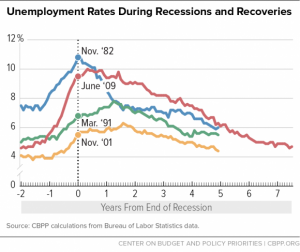

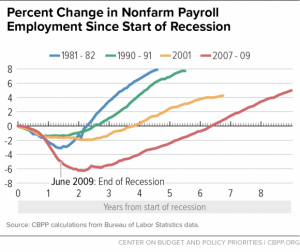

Obama labour track record not so exciting in terms of recovery vs. previous recessions

Obama labour track record not so exciting in terms of recovery vs. previous recessions

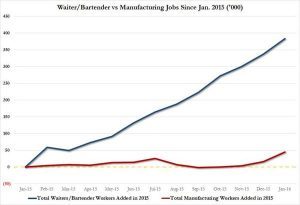

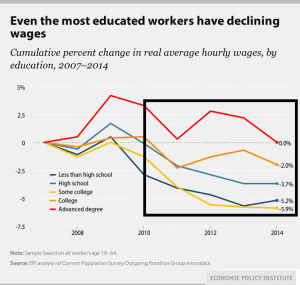

Occupation recovery after 2008 is mainly related to low level job, normally not very well paid

Occupation recovery after 2008 is mainly related to low level job, normally not very well paid

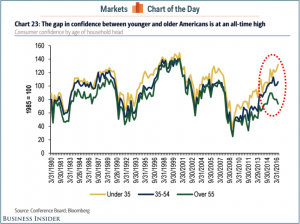

In such very challenging economic environment cross generational conflicts seem almost inevitable

In such very challenging economic environment cross generational conflicts seem almost inevitable

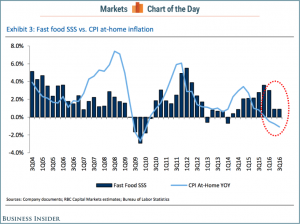

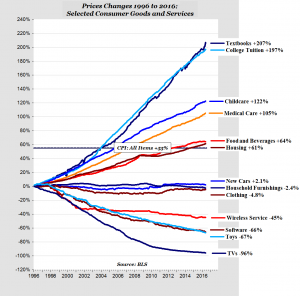

It is very interesting to check which kind of US consumptions have increased in terms of relative cost

It is very interesting to check which kind of US consumptions have increased in terms of relative cost

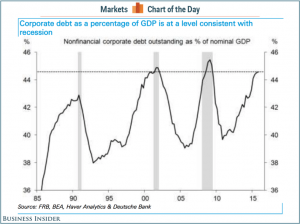

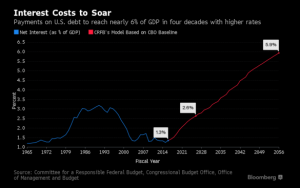

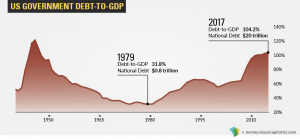

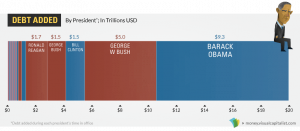

Federal debt growth under Obama is definitively impressive; but at the same time, even with huge state expenditure, the resulting GDP growth is not impressive at all

Federal debt growth under Obama is definitively impressive; but at the same time, even with huge state expenditure, the resulting GDP growth is not impressive at all

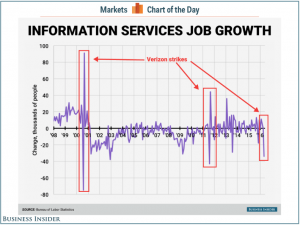

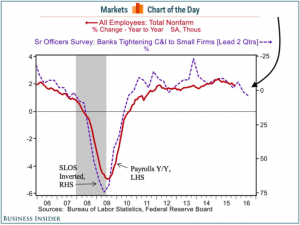

Slow Nonfarm Payroll employment growth since 2008, with recent signs of progressive weakness?

Slow Nonfarm Payroll employment growth since 2008, with recent signs of progressive weakness?

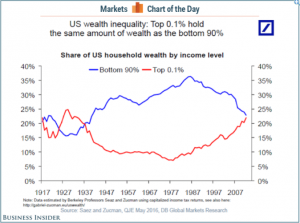

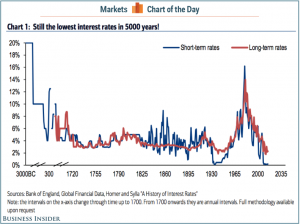

Debt servicing costs are expected to grow substantually, a time bomb for the US balance sheet (please consider that today we are at historical low in terms of global interest rates)

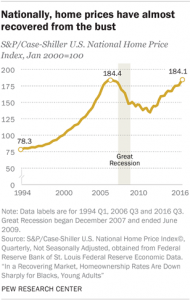

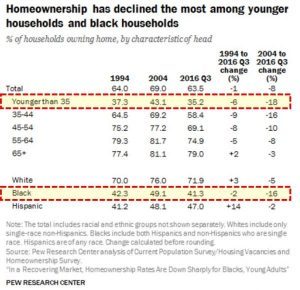

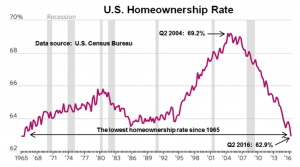

Debt servicing costs are expected to grow substantually, a time bomb for the US balance sheet (please consider that today we are at historical low in terms of global interest rates)  Home ownership rate is at the lowest level since 1965

Home ownership rate is at the lowest level since 1965

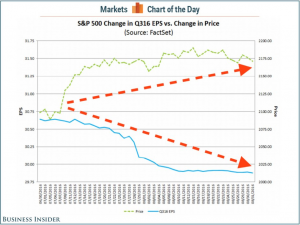

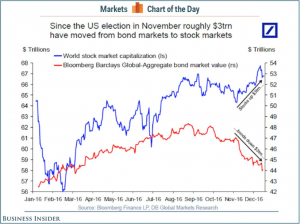

Now the markets: after the election of Donald J. Trump we have noticed a clear disconnection between share price and fundamentals, therefore a retracement might reasonably be expected quite shortly (many expect that Wall Street is going to blame the next President for the crash, do you?) :

The markets, driven not only by financial institutions but also by central banks purchases, have decoupled from fundamentals, starting just 12 hours after the presidential results

The markets, driven not only by financial institutions but also by central banks purchases, have decoupled from fundamentals, starting just 12 hours after the presidential results

US Dollar has substantially strenghtened after the US election; a negative effect is expected in terms of corporate profits especially in the US manufacturing sector

US Dollar has substantially strenghtened after the US election; a negative effect is expected in terms of corporate profits especially in the US manufacturing sector

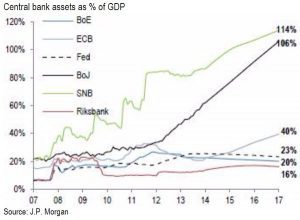

A last word about central Banks interventions in the markets: something happened during the Obama double mandate, possibly supporting globalists efforts to keep the market working “as expected”…

A last word about central Banks interventions in the markets: something happened during the Obama double mandate, possibly supporting globalists efforts to keep the market working “as expected”…

We must ask ourselves why Obama is so determined to highlight only positive economic data in terms of legacy of his presidency.

Three reasons. The first and simplest: it has a lot to hide, I feel that soon it will be clear to everybody (if and) how bad both his economic and foreign policy legacies are; an economic collapse seems very probable, maybe almost inevitable. Most notably throughout his last mandate it seems that the current US Presidency used to at least partly conceal the reality of things in terms of economic performances: in other words the US economic situation seems not as bright as somebody wants us to believe.

Second: most likely he (or his wife) hopes to reapply for a next term as President of USA after Trump and if this will not be possible at least to support the argument of a good Presidency, encouragement for an another US black Commander in Chief.

But the most important reason is this: Obama effort is very similar to Bill Clinton’s effort when he underpinned an overstretched US equity market with every kind of support before the election of 2000, notably the abolition of the Glass Steagall Act that caused the subprime crisis 10 years after: bear in mind that the presidential election in 2000 (when Al Gore lost to G.W. Bush) took place in November, sworn January 20th, and lately in 2001 we had the collapse/dotcom bubble bursting, starting on 9th March. Then came the twin towers, almost exactly six months later.

Well, I expect something similar to happen in 2017, I’m already selling my equity portfolio. Today it seems that everybody – supporting the Dem even after such astonishing presidential defeat – wants to kick the can into the opponent’s field, to the the next Presidency, e.g. Donald J. Trump will have to cope with the subsequent market turmoil. Incredibly, the same media that were supporting Hillary Clinton as US President are now changing their mind, no recession expected, they were wrong… I am pretty sure they are ready to strike at the next President as soon as market start crashing, blaming him for almost everything instead of looking carefully into the Obama economic track record…

For these reasons today Obama must give the impression of a super-positive legacy, as this is the real means by which the US financial sector, essentially in the hands of Dem, will try to undermine the Trump presidency, blaming him for the (expected) fall in stock prices and the economic disaster that will follow.

For these reasons today Obama must give the impression of a super-positive legacy, as this is the real means by which the US financial sector, essentially in the hands of Dem, will try to undermine the Trump presidency, blaming him for the (expected) fall in stock prices and the economic disaster that will follow.

The virtual reality of a supposedly constantly (albeit moderately) growing economy is slowly giving way to a recessive scenario: the blame for the future collapse of shares – derived from the poisoned legacy that Obama is leaving behind – must be burdened by the next President. Please never forget the statistical economic data misinterpretation throughout the Obama mandate – it seems that to some extent also the markets are hiding the potential disaster thanks to the post electoral connivance of Wall Street -, never forget the share grants acquired directly by central banks in unprecedented proportions in capitalistic history in order to sustain markets (e.g., one of the biggest Apple shareholders is the Swiss National Bank).

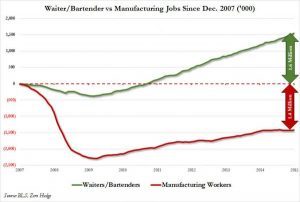

Think about the unemployment official metrics: it is only fiction to say that unemployment has fallen. In fact Obama had the brilliant idea to avoid discussing about the labour force participation rate hovering around 45 years low, it is a matter of fact that the systematic removal of people from the official unemployment computation if not actively seeking jobs is misguiding with regard to the correct understanding of the economic situation, by the way the same trick has been applied in Italy by Matteo Renzi – a solid ally of the Clinton clan – (sorry to say that such “copy and paste” approach will cause an immense disaster in Italy in the months to come). The true Obama legacy is also made of a socio-economic internal division, so evident to force comparisons to the pre civil war period; add an intergenerational conflict of epic proportions, an occupation of very low quality (and related low wages) and a huge accumulation of wealth by the financial elites never seen in history (at least I absence of a declared war) and you have the full picture of the real Obama legacy. I think it is worth to recall the 9 graphs zerohedge.com published at the beginning of the US presidential campaign, sorry to say that – honestly – they show the same (dire) economic path as the one we can deduct from the slew of slides we proposed above:

The tragic aspect is that the dire US economic data under Obama go hand in hand with a strong reduction of personal freedom due to the massive federal espionage status of computer data and press reports, a warmongering presidency by number of conflicts, a huge number of US destabilisation actions in just 8 years (unparalleled in history terms). Last but not least, let’s add the systematic “fake news” trend we clearly spotted during the last presidential election, in order mainly to discredit Donald Trump (see recent politico.com comments on that, please also refer to recent CIA and CNN reports against Trump, the infamous pissgate); in parallel the Clinton Foundation scandals were hidden as much as possible by the media, scandal that emerged via Wikileaks – please notice that almost none of the Wikileaks mail have been officially challenged in their contents, it was just argued the way how such mails were made public, supposedly through Russian hacking.

Mala tempora currunt.

Mitt Dolcino

(www.scenarieconomici.it)

Grazie al nostro canale Telegram potete rimanere aggiornati sulla pubblicazione di nuovi articoli di Scenari Economici.